Blog Search

The Budget in Review: Canada’s Bold Housing Strategy, a Blueprint for Affordable Living

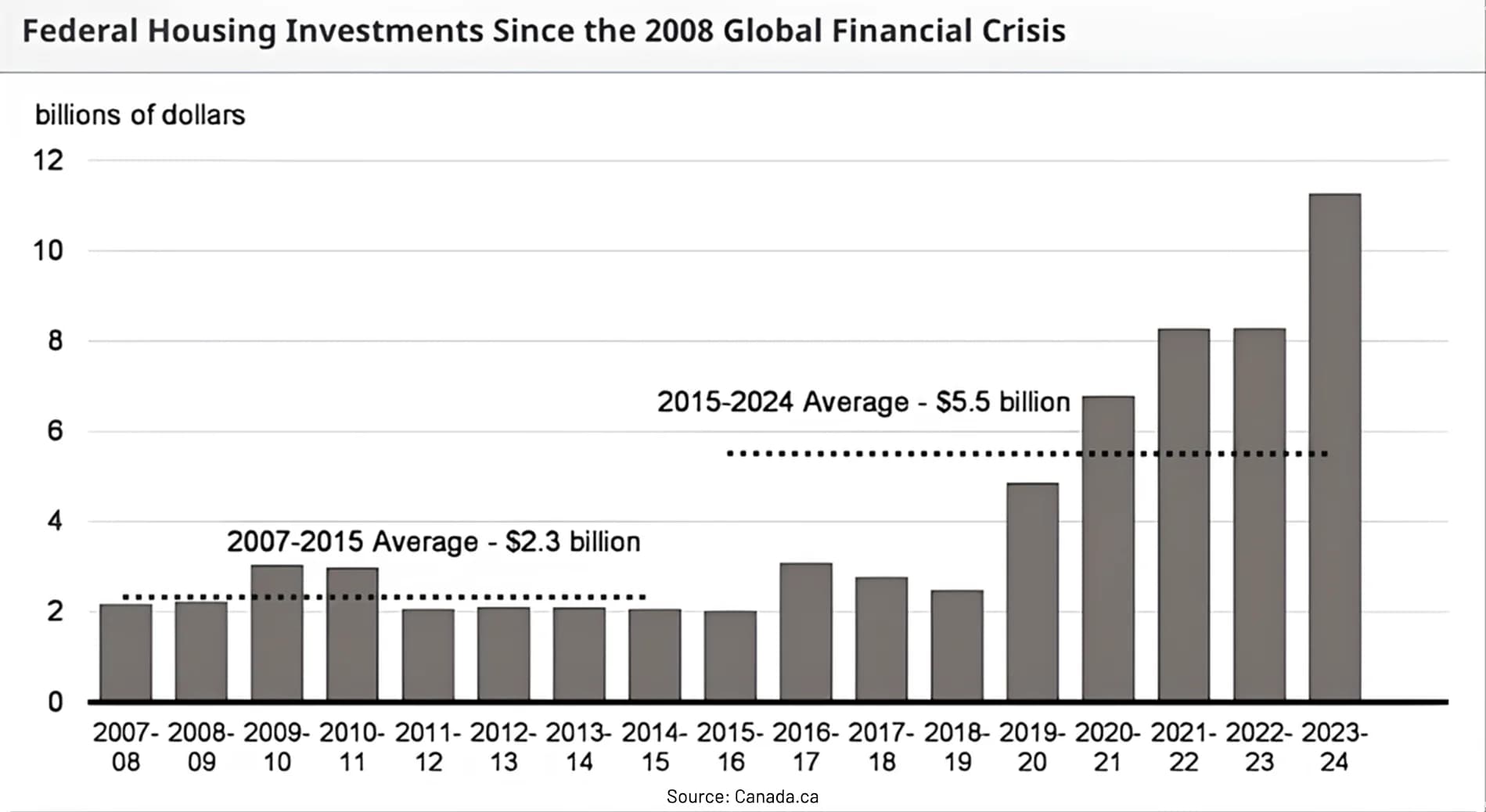

The 2024 Canadian Federal Budget, announced by Canada’s Deputy Prime Minister and Finance Minister Chrystia Freeland on April 16, 2024, marks a significant step towards accelerating productivity, unlocking innovation through AI, increasing investment to support businesses of all sizes and perhaps most importantly facing the Canadian housing crisis head-on.

Yes in the 2024 Budget, the government announced several initiatives aimed at addressing the Canadian housing market, particularly focusing on making homeownership more accessible and affordable.

THE INITIATIVES

Increasing the RRSP Home Buyers’ Plan withdrawal limit to $60,000 from $35,000, allowing Canadians to withdraw more funds tax-free for the purchase of their first home.

Allowing first-time homebuyers with an insured mortgage to extend their mortgage amortizations to 30 years from the typical 25 years, which can reduce monthly carrying costs but may increase the total interest paid over the loan's lifetime.

Proposing $8.5 billion in new housing initiatives with the goal of building 3.87 million homes by 2031, aiming to address Canada's supply gap and stimulate the construction of new rental housing.

Introducing a Canadian Renters’ Bill of Rights to combat unfair practices in the rental market and changes that would allow monthly rent payments to count towards building a credit score.

Modernizing housing data with $20 million allocated to Statistics Canada and CMHC to enhance the collection and dissemination of housing data.

These measures are part of a broader strategy to address the housing affordability challenges facing Canadians, with a focus on both short-term relief for homebuyers and long-term solutions to increase housing supply and make homeownership more accessible.

THE STRATEGY

The central pillar of the plan is a simple yet powerful concept: increasing housing supply. By building more homes, the government aims to cool the overheated market and make housing more affordable for Canadians. Several key initiatives are driving this approach:

The Affordable Housing and Groceries Act: This act removes the GST on new purpose-built rental projects, making it less expensive for developers to build new rental units.

Supercharged Financing: The Apartment Construction Loan Program is receiving a significant boost of $40 billion, providing low-cost financing for the construction of over 101,000 new rental homes across Canada. Additionally, unlocking $20 billion in new financing through Canada Mortgage Bonds will allow for the construction of an additional 30,000 rental apartments per year.

The Affordable Housing Fund: This $14 billion fund is dedicated to building 60,000 new affordable homes and repairing a further 240,000 existing units.

Housing Accelerator Fund: Municipalities are being incentivized to streamline zoning regulations and expedite housing construction through the $4 billion Housing Accelerator Fund. This approach is projected to fast-track the construction of at least 100,000 homes in the next three years and over 750,000 across the next decade.

THE IMPACT

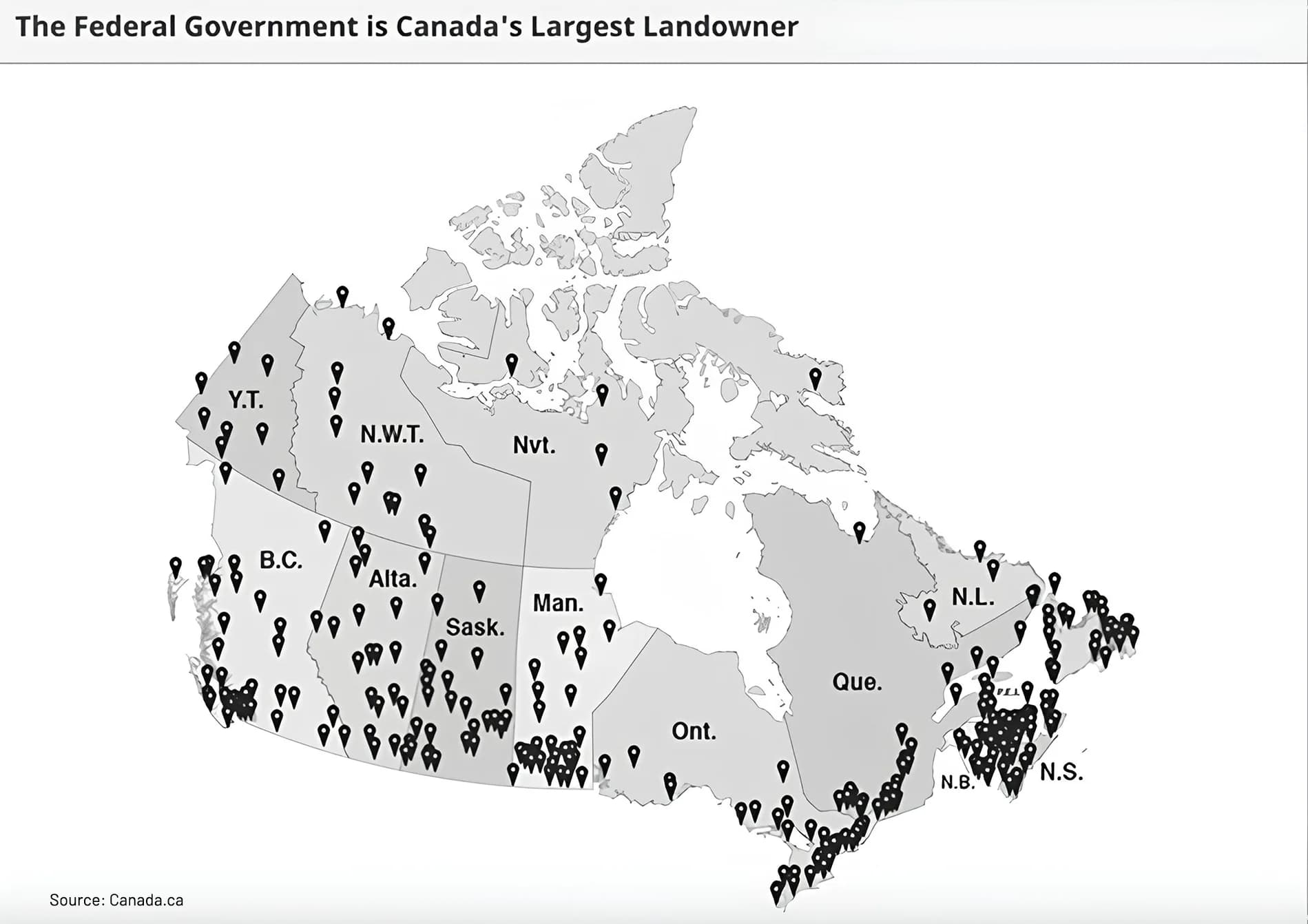

01Building on Public Land

Canada's vast public land holdings present a unique opportunity. The government is claiming to be committed to identifying and utilizing surplus and underutilized federal lands for new housing developments. This strategy not only increases available land but can also potentially reduce development costs, leading to more affordable housing options.

02Supporting Vulnerable Canadians

The plan recognizes the immediate needs of our most vulnerable citizens. A $1.3 billion investment in Canada's Homeless Strategy and $1.5 billion to help non-profit organizations acquire rental housing will ensure continued support for those experiencing homelessness and maintain vital ultra-affordable housing options.

03A Brighter Future for Homeownership

While increased supply is crucial, Budget 2024 acknowledges the ongoing challenges faced by first-time homebuyers. The long-term goal is to ensure that purchasing a home remains a realistic possibility for future generations. While the full impact of these measures remains to be seen, the focus on increasing supply and potentially improving credit approval processes for first-time buyers offers a glimmer of hope.

Read More: Tightrope Walk: Why the Bank of Canada Needs To Ease Up on Interest Rates

THE FUTURE: A LITTLE BRIGHTER?

The road to achieving these ambitious targets will undoubtedly be challenging. Construction timelines, skilled labour shortages, and navigating complex intergovernmental partnerships are just a few of the hurdles that need to be overcome. Ultimately, the success of Canada's Housing Plan hinges on strong collaboration between federal, provincial, and municipal governments, as well as the private sector and community stakeholders.

Despite the challenges, Canada's Housing Plan represents a significant step forward. By focusing on increasing supply, utilizing public land strategically, and supporting vulnerable Canadians, the government is taking concrete steps to address the housing crisis. The future of Canadian housing remains to be written, but with this comprehensive plan in place, there's reason for optimism.

Blog Search

Popular Blogs

Popular Blogs

The trademarks MLS®, Multiple Listing Service® and the associated logos identify professional services rendered by REALTOR® members of CREA to effect the purchase, sale and lease of real estate as part of a cooperative selling system.