Blog Search

Tightrope Walk: Why the Bank of Canada Needs To Ease Up on Interest Rates

The Bank of Canada (BoC) has been aggressively raising interest rates since late 2022 to combat high inflation. While this strategy has shown some success in dampening price increases, it's becoming increasingly clear that the BoC can't maintain these elevated rates for much longer. Let's delve into the key factors pushing the Bank towards a potential pivot in its monetary policy and why The Canadian Home believes that in 2024/early 2025 rates are set for a decrease.

The Crushing Weight of Debt

The COVID-19 pandemic played a significant role in the current economic situation. With businesses and individuals facing financial hardship, many turned to loans to stay afloat. This resulted in a surge in both government and household debt. As economies reopened and demand surged post-pandemic, this additional debt load coincided with supply chain disruptions, further pushing inflation upwards.

Canadians are swimming in a sea of debt. Statistics Canada reports that household debt reached a staggering $1.79 for every dollar of disposable income in Q4 2023. This translates to an enormous financial burden for Canadians, especially with rising interest rates. Each interest rate hike increases the minimum monthly payment on mortgages and other loans, squeezing household budgets further.

Furthermore, recent quarters have witnessed an uptick in borrowing, particularly mortgages. This trend suggests that Canadians are feeling the pinch and resorting to more debt to maintain their standard of living. However, with interest rates expected to stay high for some time, this strategy becomes unsustainable. The BoC risks pushing Canadians into a debt spiral, where rising interest payments limit their ability to spend and invest, further hindering economic growth.

Investment Slump Threatens Future Growth

Another worrying trend is the slowdown in business investment. Real (inflation-adjusted) business investment declined by nearly 7% in the latter half of 2023. This follows a long underinvestment stretching back to the 2008 financial crisis and the 2015 oil price crash. Lower business investment has a ripple effect, impacting future productivity growth, which is the primary driver of rising wages and improved living standards.

Thankfully, some early surveys hint at a potential rebound in investment for 2024. Statistics Canada's data shows a planned increase of 4.5% in non-residential spending. However, for long-term prosperity, Canada needs a sustained period of robust investment alongside better utilisation of the skills of newcomers.

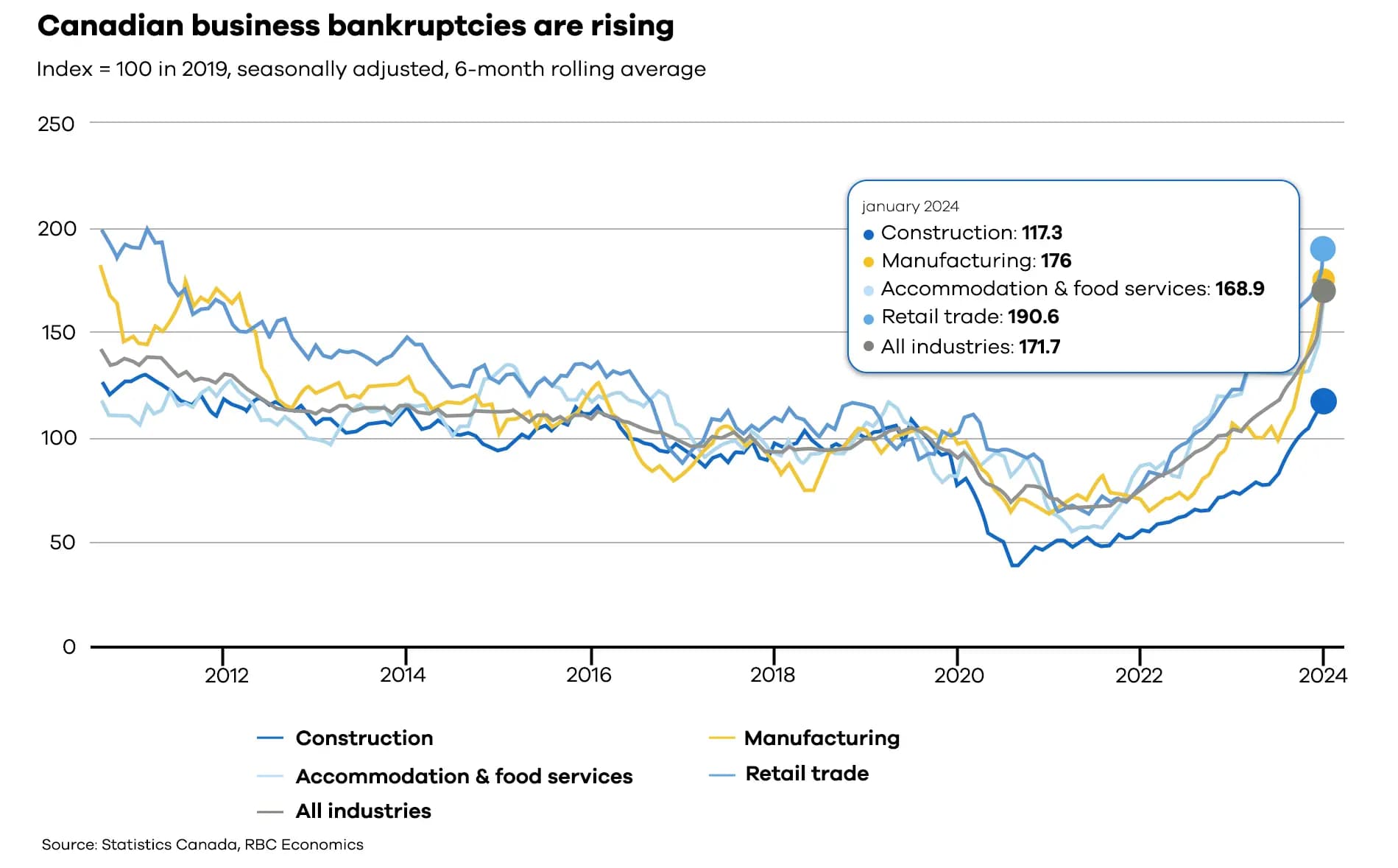

Business Defaults on the Rise

As interest rates climb, the risk of business defaults also increases. Companies that borrowed heavily during low-interest periods face challenges meeting their debt obligations with higher interest payments. A surge in business bankruptcies isn't just bad for jobs; it also disrupts supply chains and weakens overall economic activity. The BoC needs to tread carefully to avoid pushing otherwise healthy businesses over the edge.

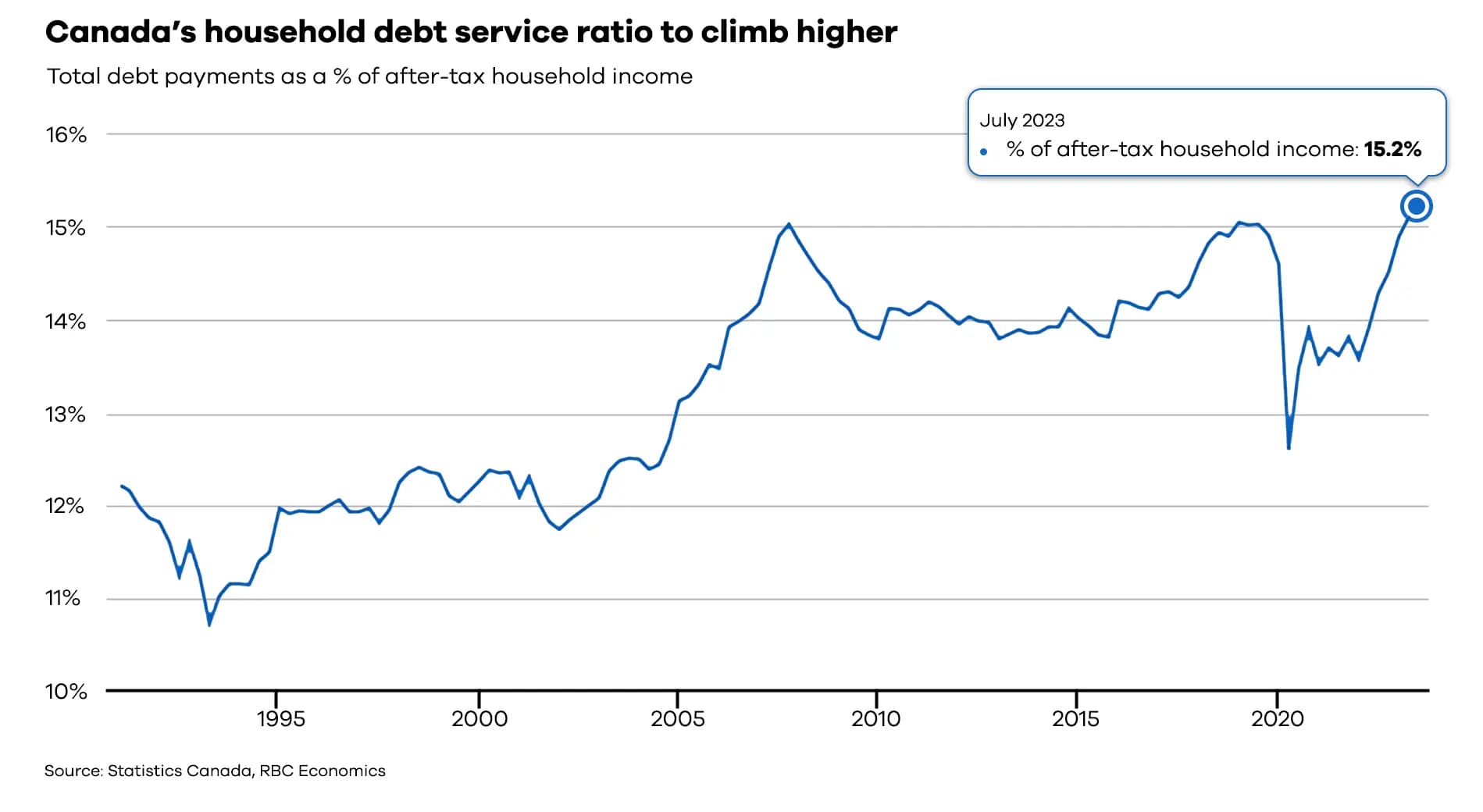

Household Debt Payments on a Collision Course:

The ratio of household debt payments to disposable income is already at record highs and is poised to rise further as mortgages get renewed at higher interest rates. This means Canadians will have less money available for other expenses, dampening consumer spending, a vital pillar of the Canadian economy.

Rising delinquency rates (missed or late loan payments) and a sharp increase in business bankruptcies are early signs of stress in the system. Deteriorating housing affordability adds another layer of strain. Even with inflation moderating, home prices remain high, and rents are skyrocketing. This situation leaves Canadians with less disposable income, hindering economic growth.

Finding the Balance

The Bank of Canada faces a delicate balancing act. While inflation remains a concern, the BoC risks stalling economic growth and causing financial hardship by keeping interest rates too high for too long. The enormous household debt burden, slowing investment, rising defaults, and squeezed household budgets all point to the need for a potential shift in monetary policy.

Ideally, Canada strives for an unemployment rate between 5-6%, GDP growth of 2-3%, and inflation below 2%. These numbers represent a sweet spot – a growing economy with manageable inflation and healthy employment levels.

The Bank of Canada might need to consider lowering interest rates in the near future, even if inflation hasn't completely normalized. This would provide some much-needed relief to Canadian households and businesses, allowing them to breathe and invest, ultimately fostering a more sustainable and healthy long-term economic growth trajectory.

Looking Forward: Potential Rate Relief on the Horizon?

While the first half of 2024 is unlikely to see a decrease in interest rates due to inflation concerns, the latter half might offer some relief. The BoC may strategically lower interest rates to provide much-needed breathing room for Canadian households and businesses. This will allow them to manage their debt, invest, and ultimately contribute to a more sustainable and healthy long-term economic trajectory.

By carefully navigating this challenging scenario, the BoC can hopefully guide Canada towards a period of both controlled inflation and healthy economic growth. As Canadians, staying informed about economic developments and making informed financial decisions is crucial as the economic landscape continues to evolve.

Blog Search

Popular Blogs

Popular Blogs

The trademarks MLS®, Multiple Listing Service® and the associated logos identify professional services rendered by REALTOR® members of CREA to effect the purchase, sale and lease of real estate as part of a cooperative selling system.