Blog Search

Ontario Housing Market Set for a Spring Boom: Prices Rise, Economy Stabilizes, and Activity Heats Up

The latest numbers are in and The Canadian Home is happy to report that things are looking on the bright side once again. Following a challenging year in 2023, characterized by inflation, rate hikes, and a notable slowdown, the Ontario housing market is showing signs of recovery. The efforts to combat inflation and stabilize rates seem to be bearing fruit, with indications pointing towards a resurgence in market activity as spring approaches. This turnaround is a welcome development, suggesting a return to a more vibrant and dynamic real estate landscape in Ontario.

The Numbers

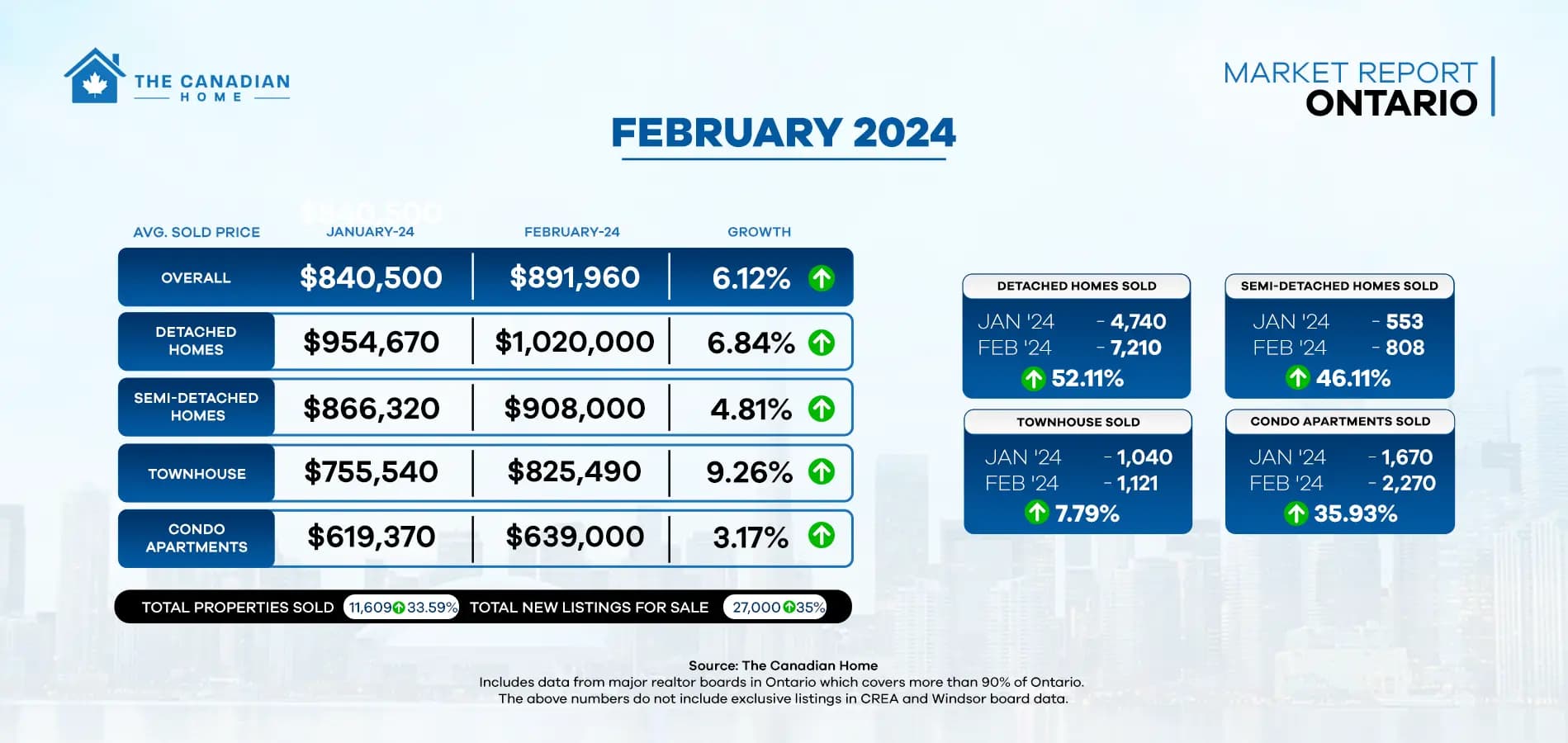

The latest numbers show that home prices in Ontario went up by 6.5%, making the new average price $840,000. Since more people are buying homes and more homes are being sold, it's no surprise that prices are rising. This means three things:

First, there will be a lot of competition among buyers in the coming months.

Second, more people will want to sell their homes, giving buyers more choices.

And third, since more homes are being sold and listed, prices will likely keep going up and competition among the buyers will increase.

In just a month, from January to February, there has been a significant rise in new listings, transactions, and home prices for all types of properties. Detached homes are leading the way, with the highest numbers once more. This shows that the Ontario housing market is getting ready for a red-hot spring market.

A Stabilizing Economy

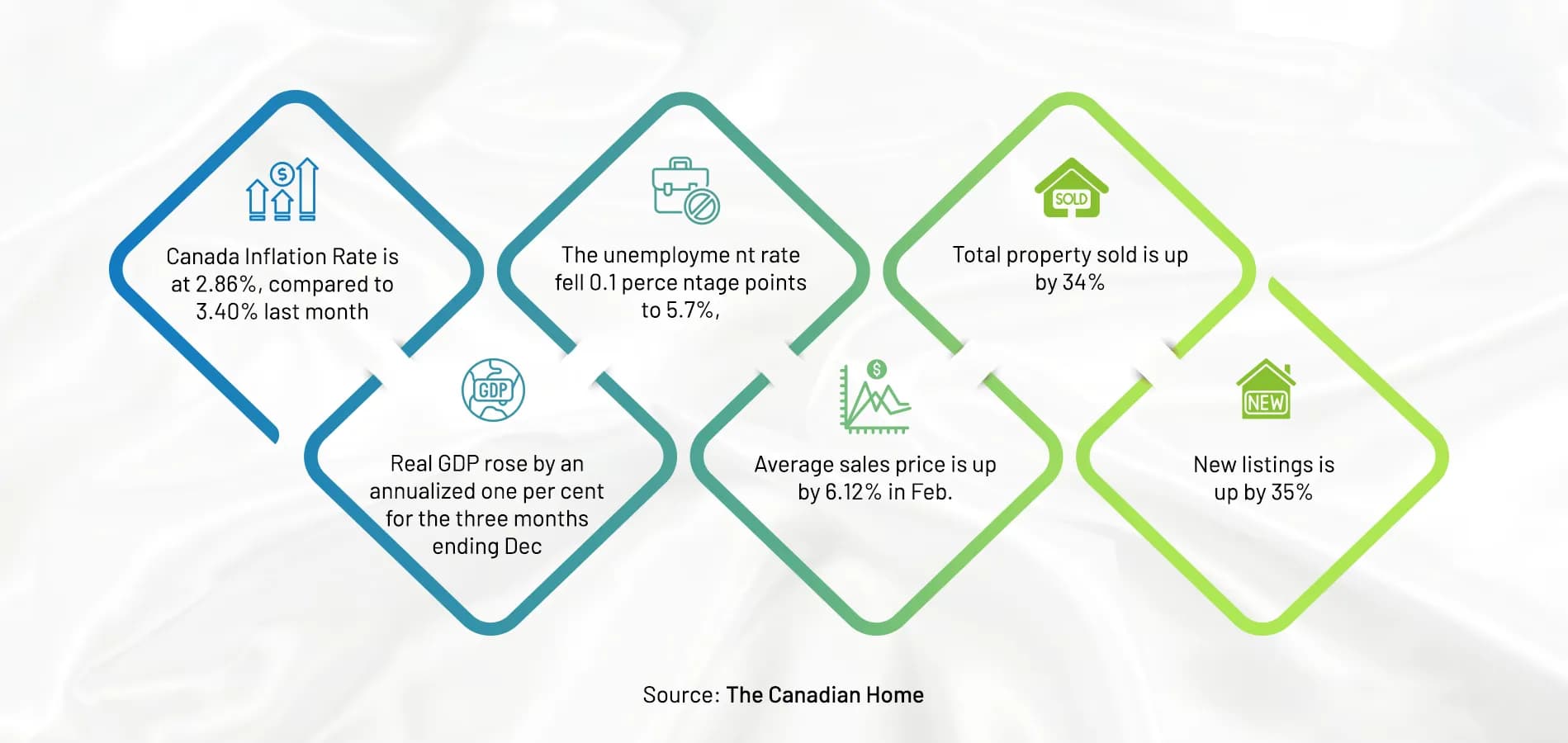

With the Canadian economy showing signs of robust growth, with a 1.0% uptick in the fourth quarter of 2023, recent economic indicators are brimming with positivity. January 2024 saw a significant drop in inflation to 2.9%, marking its lowest point since June 2023. This downward trajectory in inflationary pressures is indeed a reason to celebrate after months of higher rates. Additionally, the unemployment rate saw a modest dip of 0.1 percentage points to a commendably low 5.7%. This decline, the first since December 2022, underlines the resilience of the Canadian job market, which continues to thrive compared to its pre-pandemic state.

According to Robin Cherian CEO of The Canadian Home, "Such encouraging trends signal an improving phase for the Canadian economy, offering ample room for growth and prosperity. With inflation easing and unemployment remaining at historically low levels, Canada is poised for a period of sustained economic vitality and expansion. We expect the prices to go up in the coming months but marginally."

The Rate Factor

As expected and predicted by The Canadian Home, the Bank of Canada chose to hold the policy rates at 5% once again. This marks the fifth consecutive rate hold since July 12th, 2023, affirming the market's confidence in the central bank's measured approach to monetary policy. With the dust settling from previous rate adjustments, the Canadian Home stands firm in its belief that the BoC will continue to hold the rate steady.

According to Manoj Karatha Broker of Record for The Canadian Home “One of the primary motivations behind the BoC's past rate hikes has been to tame inflation. However, while inflation rates haven't exactly hit the bullseye the BoC aimed for, they've certainly cooled down from the fiery heights of just a few months ago. This shift suggests that the measures taken thus far are having an impact.”

Moreover, the broader economic landscape appears to be in a stable place at present. In such times of equilibrium, maintaining the current policy rates becomes paramount. So, as we await the BoC's next move, it seems increasingly likely that the rate will remain unchanged. This decision, if realized, could provide a continued sense of stability to the market.

Spring Is Coming

As spring arrives in Canada, the housing market starts buzzing with activity. It's the busiest time of year for buying and selling homes, and the numbers clearly show it. More houses are being put up for sale, and their prices are going up too.

Every month, more people are jumping into the market as both buyers and sellers. This trend is especially strong in Ontario, where things are expected to get even busier and more competitive as spring kicks off. If you're thinking about buying a home, now's the time to start getting ready. With lots of action expected in the coming weeks, it's a good idea to be prepared and ready to make your move in this lively market.

Blog Search

Popular Blogs

Popular Blogs

The trademarks MLS®, Multiple Listing Service® and the associated logos identify professional services rendered by REALTOR® members of CREA to effect the purchase, sale and lease of real estate as part of a cooperative selling system.